Going Digital with WageCan to Keep the Gig Economy Running

ref: https://newsroom.mastercard.com/wp-content/uploads/2019/05/Gig-Economy-White-Paper-May-2019.pdf

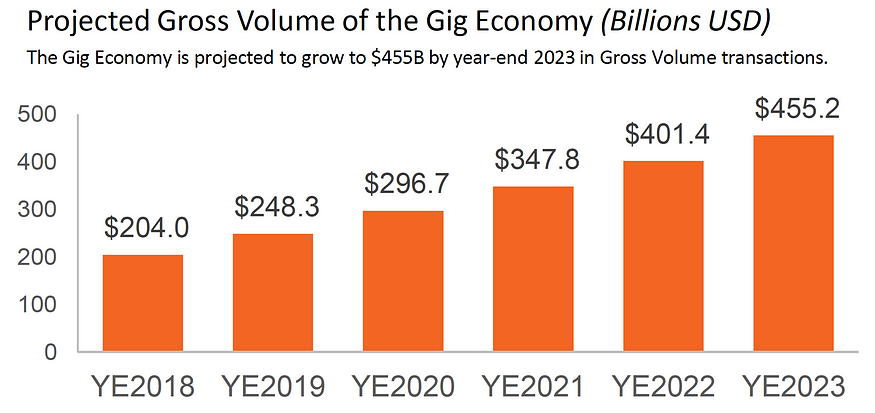

A study confirmed the rapid development of the global Gig Economy, projecting double-digit annual growth for the industry by 2023. Growth brings change, and the Gig Economy is about to go through more of it than the traditional labor market has in decades. The size of Gig Economy transactions is projected to grow by a 17% CAGR with a Gross Volume of 455B by 2023, due to factors such as increasing digitization rates in developing countries and evolving societal attitudes around P2P sharing. With Upwork and the American Freelancer’s Union estimating that by 2027, over half of the country’s workforce would be made up of freelancers.

ref: https://newsroom.mastercard.com/wp-content/uploads/2019/05/Gig-Economy-White-Paper-May-2019.pdf

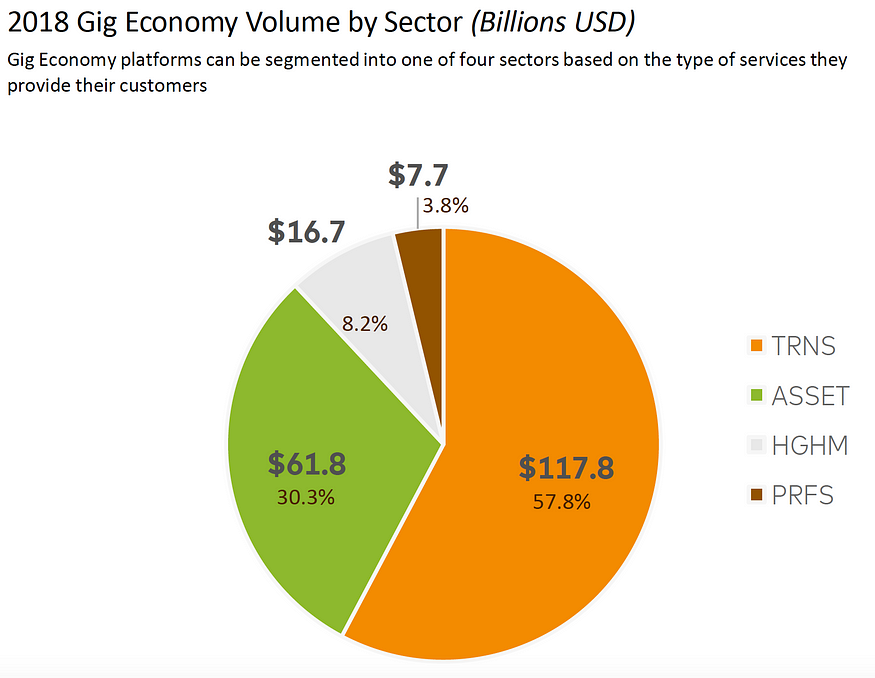

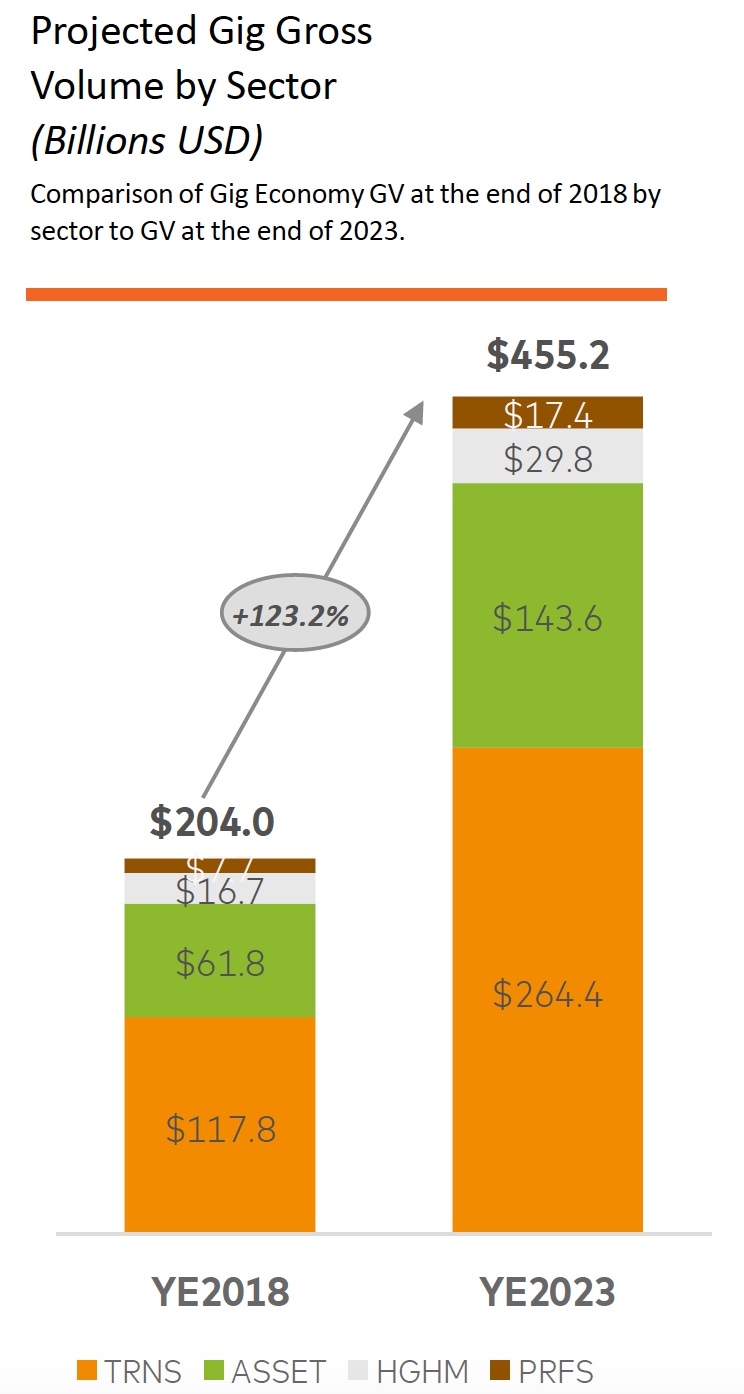

When the global Gig Economy has reached $455B by the end of 2023, transportation-based Services are estimated still to the lead the Gig Economy by a significant margin, followed by Asset-Sharing Services, then HGHM (Handmade Goods, Household and Miscellaneous Services), followed by Professional Services. The growth rates for Gross Volume, Disbursement, and freelancer participation are projected to be positive across all sectors, with GV CAGRs ranging from 12–18% by sector.

ref: https://newsroom.mastercard.com/wp-content/uploads/2019/05/Gig-Economy-White-Paper-May-2019.pdf

With a projected GV growth of 123% over five years from 2018 to 2023, there exist a number of societal, economic and technological trends that are driving Gig Economy expansion today and will continue to spur industry development in the future. The increasing supply of Gig Economy freelancers offering their services to Gig platforms is motivated by the following factors: Evolving social attitudes about P2P sharing, Increasing digitization rates, a cultural shift toward embracing a “flexible” work-life environment, the rising costs of living paired with a shrinking middle class.

The Gig Economy can be characterized by digital platforms that allow freelancers to connect with individuals or businesses for short-term services or asset-sharing. Platforms can look to partner with third-party innovators to promote freelancer loyalty. Both giants and up-and-coming digital platforms are competing fiercely for Gig workers, particularly when expanding to new markets where a sizeable pool of workers is needed to encourage demand by customers. Because a majority of Gross Volume comes from platforms that are relatively new to the market, the outlook for continued industry expansion is positive. Gig platforms are projected to continue extending their operations regionally and offer a greater diversity of services to customers, thus enabling the industry to expand and mature.

Freelancers often manage payments from multiple clients, which can be both beneficial and challenging at the same time. Now more than ever, reconsider your payment policy to give you greater security and less hassle. As the Gig Economy matures, automation will act as a fork in the road. The Gig Economy, at least in its 21st-century iteration, exists because of technology. Without the internet, companies would struggle to find, let alone communicate with, their off-site workers. Widespread automation will drastically change the tasks companies delegate to contractors as well as how contractors complete that work. If you work for international clients, consider using a cross-border payment solution making it more accessible, more transparent, and less costly to get paid.

WageCan is the first team in North America that has provided solutions for both digital asset payroll and wallet with a prepaid card since 2015. We focus on facilitating the use of digital asset payroll problems all the way.

WageCan aims to meet the need of:

● Gig worker and Freelancers

● Construction Companies

● Property Management

● Global Property Investments

● Fintech Companies

● Businesses seeking to pay their employees or contractors in digital assets

● Businesses looking for global expansion

Our system allows users such as Gig Workers, Freelancers, Fund Managers, Wealth Managers, Global Insurance Managers, Investment Brokers, etc. not only to manage their businesses globally but also to use multicurrency payments to employees or receive wages anywhere around the world. WageCan’s cost-effective and straightforward payment solution enables freelancers to receive funds from international clients in multiple currencies into one consolidated account. Specifically, WageCan payment technology can offer innovations to Gig platforms that can serve as an advantage over the competition to facilitate a win-win vision in the Gig Economy.