Biweekly Headlines 2023 Aug W5 – Sep W1

“In Bitcoin, you always have to prove yourself. You don’t get to coast.

And that’s a good thing.” – Jimmy Song

Biweekly News Roundup

Bitcoin has remained almost entirely locked below the $26,000 mark since Sept. 1. SEC delays decision on 6 spot Bitcoin ETF applications, pushing the eventual decision back until October. In separate announcements on Sep. 4, Saudi Arabia and Russia surprised markets, each saying they would extend oil production cuts for another three months until December. The news on oil in the short term could be considered bearish for bitcoin prices. BTC plumbs 6-month low near $25K and higher oil prices suggest further pressure. Crypto’s total trading volume is the weakest since 2020 and crypto spot trading is at its lowest level since March 2019 with weekly Bollinger Bands all near record lows. The Tokenized Asset Coalition was launched on Sep. 6th with the aim of bringing the next trillion dollars of assets on-chain through education, advocacy and fostering adoption of public blockchains, asset tokenization and institutional DeFi in the broader financial space. Tokenized assets have the potential to disrupt the current financial infrastructure and create a more efficient system, Bank of America said. The market for tokenized assets could mushroom to $16 trillion by 2030, according to a Boston Consulting Group report. The battered crypto market awaits the Bitcoin blockchain’s fourth mining reward halving, due in April 2024. Previous halvings happened in November 2012, July 2016 and May 2020, with bitcoin chalking out triple-digit price rallies to new record highs in the subsequent 12-18 months.

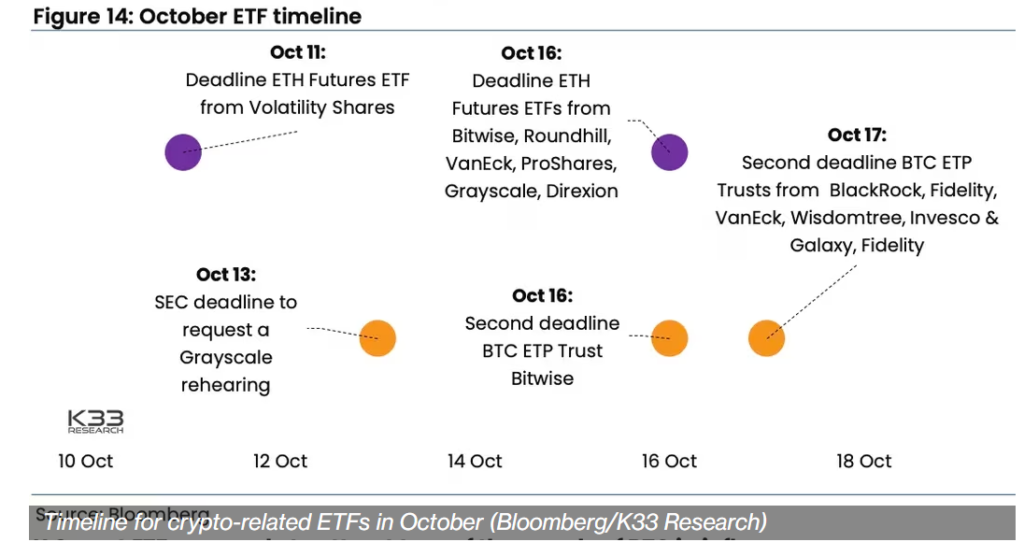

K33 Research noted that bitcoin gained 60% in the three weeks ahead of the launch of its first futures-based ETF two years ago, so Ether is set to gain relative to bitcoin in the short term due to the likely approval of a futures-based ETF next month and the market underestimates the buying pressure of a spot bitcoin ETF. Bernstein reported that crypto ETF opportunity doesn’t stop at BTC and will extend into multiple digital assets. Cathie Wood’s ARK Invest files for its first spot Ether ETF on Sep. 6, the first attempt to list such a fund in the U.S. that directly invests in ETH. Grayscale Ethereum Trust (ETHE) discount drops to the lowest in a year amid spot Ether ETF push.

Genesis Global Trading (GGT) will close its over-the-counter trading platform on Sept. 18. Binance’s Head of Product has departed amidst an ongoing executive exodus. Concurrently, Binance ceased lending for BUSD on September 6 and will halt Binance-peg BUSD withdrawals via BNB Chain, Avalanche, Polygon, and Tron starting September 7. Visa announced on Sep. 4 an expansion in its stablecoin settlement capabilities with Circle’s USDC stablecoin to the Solana blockchain. Solana YTD inflows suggest it’s the most loved altcoin. Google will allow ads for NFT games starting Sept. 15, provided the games and ads don’t promote gambling.

The Turkish-lira-backed TRYB is second only to Tether’s euro-pegged EURt in market cap after quadrupling in just three weeks. The results of Singapore’s presidential election were announced on September 2. Former Deputy Prime Minister and State Counselor, Tharman Shanmugaratnam, has been formally elected as the ninth President of the Republic of Singapore, securing an impressive 70.4% of the total votes. He said that blockchain technology is commendable, yet there is a pressing need for clear regulatory frameworks for cryptocurrencies. India G20 says that crypto is a “threat as well as an opportunity” while confirming that G20 members are working toward establishing a global crypto framework.

September 9, 2023