Bitcoin in Your Portfolio – Enterprise Bitcoin Trends That Will Drive Adoption in 2021

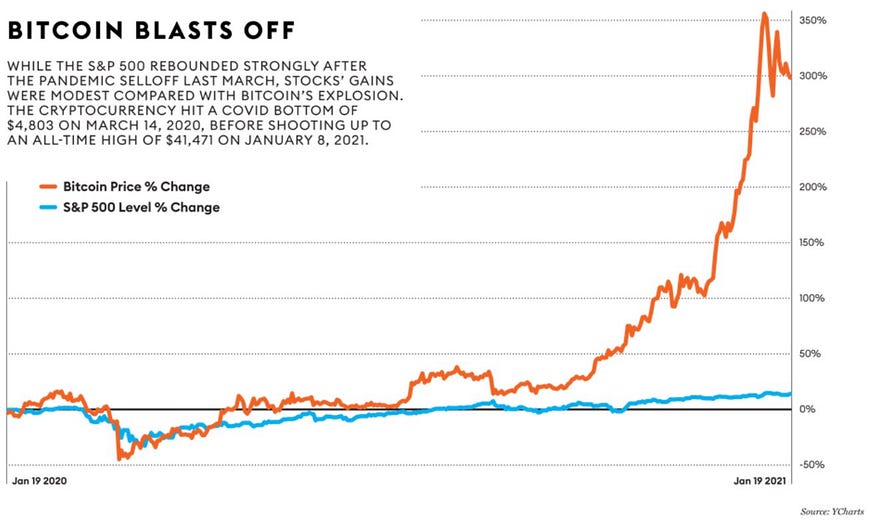

It’s true that 2020 was a significant, dramatic year not only for people around the world but for Bitcoin as well: the third halving, increased attention from institutional investors and global regulators, its white paper’s 12th anniversary, etc. Some even called it the “New Testament” of finance while the price of Bitcoin (BTC) reached new all-time highs. One thing became certain due to the impacts of COVID-19: Some serious problems with the currently existing financial system might be solved by Bitcoin and by the technology behind it. And the similarities between the two recent financial crises — the first back in 2008 and then in 2020 due to the pandemic — revealed the systemic problems of centralized financial systems. While the first crisis gave birth to Bitcoin, the current one has made people turn to decentralized tech and Bitcoin on a massive scale amid the global economic recession. Some even argue that during the next decade, Bitcoin will play a crucial role in the global economy’s transformation, called “The Great Reset.”

The governmental response to the calamities of 2020, which saw the U.S. Federal Reserve expand its balance sheet by more than 75 percent ($3.25 trillion), the U.S. Treasury accumulate $3.7 trillion in debt since the end of FY2019 and the European Central Bank add more than €2 trillion ****is unprecedented. Such a massive expansion in financial assets has many questioning the long-term value of fiat currency and looking for alternative assets such as commodities and cryptocurrencies as hedges against inflation. No longer dismissed as a haven for criminals and drug dealers, Bitcoin and blockchain have gone mainstream. Not only are companies employing the technology underlying Bitcoin to perform tasks such as reconciling invoices and verifying product provenance, but dozens are now holding Bitcoin as a treasury asset. Forbes’ third annual Blockchain 50 features companies that lead in employing distributed ledger technology and have revenue or a valuation of at least $1 billion. They take the spots of such U.S. companies as Facebook, Google, Amazon and Ripple. As well as retail outlets such as H&M and Starbucks accepting Bitcoin payments, banking, tech, and financial institutions are exploring uses for blockchain and similar digital ledgers to store data and process transactions. More and more corporations have also chosen to hold Bitcoin on their balance sheets as follows:

Goldman Sachs*(Ramin Talaie/Corbis via Getty Images)*

— Goldman Sachs & JPMorgan

U.S. banking powerhouse Goldman Sachs has reportedly to issue a request for information (RFI) to explore digital asset custody, according to a source inside the bank. A tectonic shift took place in the world of crypto custody as San Francisco-based Anchorage attained conditional approval from the OCC to become a national digital bank and “unequivocally” meet the definition of “qualified custodian” in the process. Anchorage President Diogo Mónica said in an interview this regulatory approval will invite many large and risk-averse institutional players into crypto. JPMorgan Provides $100M Financing Facility for Blockchain Mortgage Platform Figure. The facility covers both conforming and jumbo mortgages — loans in excess of the traditional lending restrictions.

— BNY Mellon

BNY Mellon, the world’s biggest custodian bank**,** is working with unnamed outside partners to build out the offering and will allow customers to custody crypto by the end of the year.

— Mastercard (MA)

Mastercard is planning to give merchants the option to receive payments in cryptocurrency later this year. The functionality will see Mastercard customers’ digital currency payments settled in crypto at participating merchants, a first for the financial giant.

PayPal CEO Dan Schulman(Getty Images)

— PayPal (PYPL)

PayPal (PYPL) allows users to transact with cryptocurrency as a funding instrument across 28 million merchants early next year. The company is already allowing customers to buy, sell and hold cryptocurrencies inside the PayPal wallet, starting in the U.S. In its investor update, the company wrote, “Customers who purchase cryptocurrency have been logging into PayPal at a rate 2x ****their login frequency prior to purchasing cryptocurrency.” The CEO and President Dan Schulman stated:

“I think that if you can create a financial system, a new and modern technology that is faster, that is less expensive, more efficient, that’s good for bringing more people into the system, for inclusion, to help drive down costs, to help drive financial health for so many people… So, over the long run, I’m very bullish on digital currencies of all kinds.”

— Amazon

As the report says, Amazon is preparing to launch a “digital currency” project in Mexico. The e-commerce giant has posted a number of job offerings, describing the project, spearheaded by Amazon’s Digital and Emerging Payments (DEP) division, as a way for customers “to enjoy online services including shopping for goods and/or services like Prime Video.”

— Elon Musk

Tesla and SpaceX founder Elon Musk, now the world’s richest man, worth over $194.8 billion, has tweeted that he wouldn’t turn down being paid in Bitcoin. He changed his Twitter bio to #bitcoin and the crypto jumped 20% to highs last seen on Jan. 19. He also tweeted a cryptic message: “In Retrospect, It Was Inevitable.”

Twitter is considering adding bitcoin to its company reserves, according to Chief Financial Officer Ned Segal. It is also looking at payment options involving the top cryptocurrency by market cap.

— Uber

Uber is considering adding crypto payment options if there is a clear benefit, CEO Dara Khosrowshahi said on CNBC Thursday. The ridesharing giant is a member of the Diem (formerly Libra) Association, is developing a payments network.

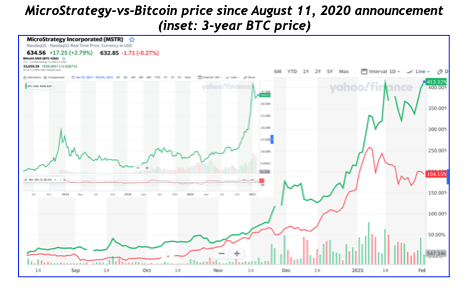

— MicroStrategy

Its share price has quadrupled, significantly outperforming Bitcoin itself since adopting Bitcoin as a primary holding in its treasury. Its stock is up 270% in 12 months. By Forbes’ count, at least 25 other publicly traded companies have Bitcoin on their balance sheets.

CEO Michael Saylor explained the company’s rationale this way:

“This investment reflects our belief that Bitcoin, as the world’s most widely-adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash. Since its inception over a decade ago, Bitcoin has emerged as a significant addition to the global financial system, with characteristics that are useful to both individuals and institutions.”

Grayscale CEO Michael Sonnenshein

— Grayscale

Grayscale Investments raised $3.3 billion across its cryptocurrency investment vehicles in last year’s fourth quarter, a record for the digital asset manager and further evidence of this rally’s institutional base. Its popular bitcoin trust once again led the pack with over $200 million in inflows every week. Michael Sonnenshein, the new CEO told Bloomberg, “We’ve started to see participation not just from the hedge fund segment, which we’ve long seen participation from, but now it’s recently from other institutions, pensions and endowments. The sizes of allocations they are making are growing rapidly as well.”

Scott Minerd (Kevin Mazur/Getty Images for Robert F. Kennedy Human Rights)

Hundreds of sizable companies are now using Bitcoin and its underlying technology to make their operations more efficient — and, thanks to its extraordinary returns, boost their profits. From JPMorgan to Boeing, Honeywell to Aramco, there have never been more businesses that qualify for Forbes’ annual Blockchain 50 list of large companies undertaking meaningful projects using this technology. Unlike the previous rapid rise of 2017, this year saw the influx of new large institutional players. New entrants are bringing a new level of credibility, liquidity and stability to the crypto markets. Scott Minerd, chief investment officer of the multi-billion-dollar investment firm Guggenheim Partners, has revised his previous prediction for bitcoin’s long-term price potential. In comments last December, the CIO had said Bitcoin could be worth up to $400,000 in time. However, on Feb. 9 this year, he said that BTC could eventually climb as high as $600,000 per bitcoin.

As more and more corporations adopt Bitcoin’s standard and use it as a store of value, as more investors and mutual funds and hedge funds use it as a store of value, as more individuals use it as a store of value, the overall amount of monetary energy, the total amount of capital flowing into the network is just going to increase in time. And because there’s a fixed amount of Bitcoin, that just means the price is going to go up…If a company is looking out a decade or longer, we think it is the right way to think about this. “Every company has to make one of two choices” when faced with a world of belligerent money printing, the MicroStrategy CEO Saylor said. “You either have to decapitalize, which is kind of like self destruct … or you have to recapitalize with an asset which is going to appreciate faster than the rate of monetary supply expansion. This is where bitcoin comes in.”