All You Need to Know about DeFi and Why It Matters

The world of traditional finance is on the brink of evolution. Long before the COVID-19 crisis took hold, global banks were scrambling to improve efficiencies and reduce costs. Most central banks have also studied the role of digital blockchain-based currency in their economies. The creation of completely decentralized and independent financial systems has since continued to gather pace amidst growing calls for data and privacy security. DeFi already has huge implications for the traditional financial system and the way we manage our wealth in the future.

To put it briefly, DeFi is an open financial sector that runs on software built on top of a public blockchain. It involves the building of financial products and services on top of a blockchain with the aim of promoting or enhancing the development of an open financial system. DeFi seeks to revolutionize the financial sector by acting as an alternative to centrally-governed institutions, such as banks, that have historically acted as financial intermediaries. It has started gaining prominence as a replacement for the traditional finance system since 2018 with the aim of building an independent, secure, and open financial system. DeFi stands out as an alternative to traditional finance because it can do away with today’s financial bureaucracy, which is a burden of today’s financial system. DeFi makes it possible for developers to come up with financial instruments capable of operating digital assets without limitations. Tokenization of pretty much everything from loans to collateral or debt obligations could also become a reality. With blockchain technologies accessible and transparent, it can make the issuance of loans, repayments, and loan terms easily readable by machines and humans. Unlike traditional banks, it removes all the layers of intermediaries and middlemen that would normally be involved through the use of smart contracts. This also removes all the high costs associated with this legacy system — and these benefits are transferred to the end-user.

Traditional finance has struggled to reach some remote parts of the world, leaving billions without access to banking services. As of 2017, 1.7 billion adults worldwide remain unbanked, according to Global Findex. Although underdeveloped countries would benefit the most from cryptocurrency, the unbanked or underbanked population spans developed countries as well. Thanks to the integration of digital ledger technologies in applications, people in remote parts of the world can now access banking services through their mobile devices. People can access the market from anywhere and anytime as long as they have internet, and it’s non-custodial, so they have full control over their money and they can use it however they want.

Today, DeFi is a market with a volume of locked funds of over $10 billion, which is becoming an alternative to banking services for thousands of users due to attractive rates for loans and deposits offered by DeFi products. Users can seamlessly exchange different tokens or refinance a loan from one asset to another. The emergence of decentralized finance can significantly narrow the gap between crypto and the traditional financial system. Moreover, according to experts, DeFi solutions are able to solve the issue of integrating cryptocurrency into the financial world even faster than the payment industry leaders such as PayPal. Within a few years, a younger generation of financial services customers are going to be able to walk into a bank and gain access to credit products, savings accounts and investments that can host both crypto and fiat assets. In fact, the inroads that will allow for all of this to happen are already breaking ground.

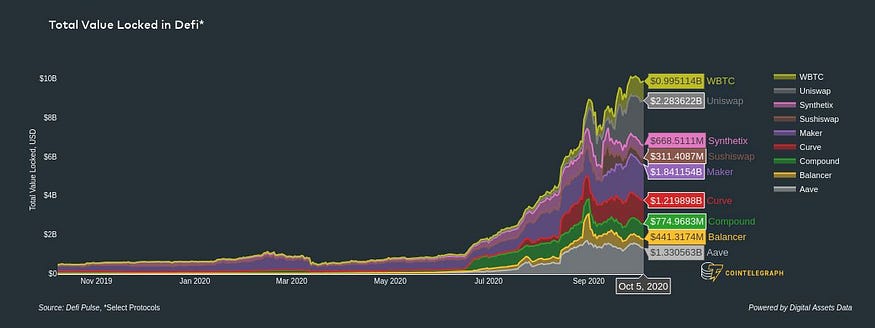

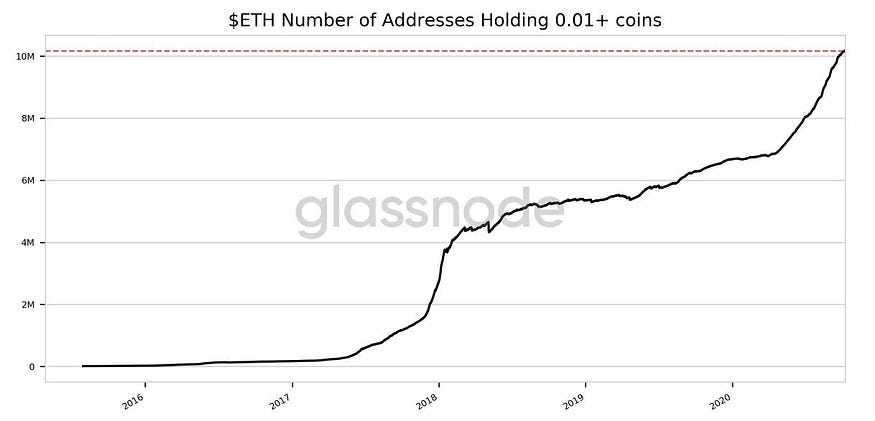

Dmitry Baimuratov, technical content lead of the OMG Network, said: “DeFi has become the major ecosystem player over the last year. The volume and interest are only growing, especially from traditional financial institutions and funds.” The DeFi sector dominated the crypto world in 2020 and it is clearly one of the main reasons for the increased interest in Ether and other digital assets. According to Digital Assets Data and DeFi Pulse, the total value locked on DeFi is sitting at $10.5 billion, having grown by 26% in the last 30 days. DeFi-tokens corrected heavily over the past 30-day but on-chain data suggest Ether is in the early stages of a bullish reversal. Data from glassnode, an on-chain analytics resource, shows the number of addresses holding at least 0.01 Ether reached a new all-time high at 10,116,076, whose growth is largely driven by the DeFi sector.

Total value locked in DeFi. Source: Digital Assets Data

DeFi projects can allow you to take technical and fundamental trading advice from other traders and only pay a fee if you make a profit. You can pour your capital into digital investment portfolios without having to pay mutual fund fees that can eat away a large sum of dollars of your retirement portfolio. Investors can also hold derivatives of their desired cryptos without having to constantly switch between blockchains. These innovations are just the tip of the iceberg. DeFi has become the center of attention throughout most of 2020, sparking talk of a renewed alt season, with many believing that mass adoption of DeFi will be coming within the next three to 10 years. As the market continues to mature, more and more DeFi projects will allow us to do things in the future that we are not even thinking about right now.

Ether addresses holding 0.01+ coins. Source: glassnode