The Next Big Inflation Hedge, Bitcoin or Gold? — Bitcoin is on the Verge of Becoming Digital Gold

In its crypto outlook for August, Bloomberg contends that the price of Bitcoin is stabilizing at six times the price of an ounce of gold, yet it contends that the asset is still undervalued. This speculation came shortly after the correlation between the two assets reached an all-time high. “Stabilizing at about 6x the per-ounce price of gold, Bitcoin’s increasing correlation and declining volatility relative to the precious metal indicate an enduring relationship for price advancement, in our view. Unparalleled global central-bank easing should remain a tailwind for the quasi-currencies.” Due to Bitcoin’s inherently similar qualities, such as limited supply and a low growth rate, Bloomberg has professed for some time now that Bitcoin is on the verge of becoming digital gold.

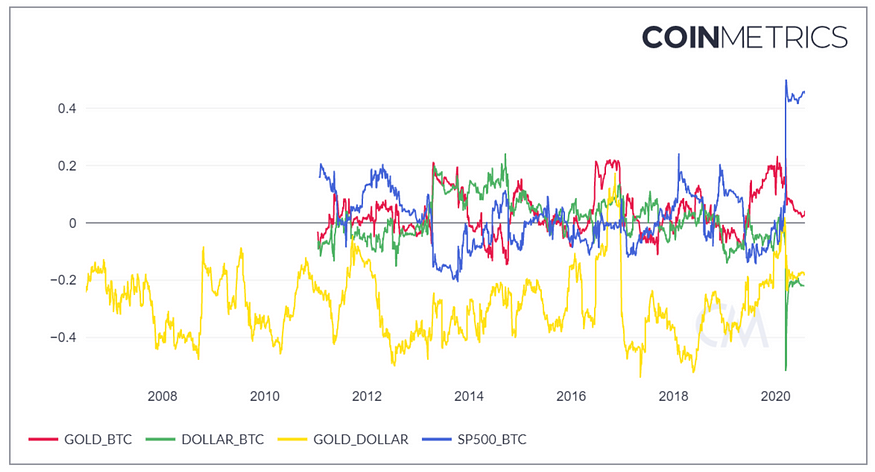

Investors have looked to gold as a hedge against fiat since the disintegration of the Bretton Woods system in 1971. Gold has consistently exhibited a negative correlation with the dollar with some very rare exceptions, while Bitcoin and the dollar have been uncorrelated with each other until recently. However, Bitcoin has demonstrated a stronger negative correlation with the dollar than gold starting from the Black Thursday crash in March. Enjoying a stronger negative correlation with the U.S. dollar than gold, Bitcoin may start to present a more attractive alternative to both in the eyes of the investors. Since Black Thursday (July 30, 2020), Bitcoin has become a better hedge against the U.S. dollar than gold. At the same time, its correlation with the S&P 500 Index reached unprecedented highs.

Correlations chart. Source: Coinmetrics

The primary attributes that underpin the price of gold and Bitcoin — limited supply, store of value, diversifier and quasi-currency — will persist in a world of unprecedented quantitative easing. The benchmark crypto has won the adoption race among myriad copycats and is maturing into a digital version of gold. The graphic depicts the highest 12-month Bitcoin-to-gold correlation at about 0.77. Having advanced to a price of about $11,400 and $200 billion market capitalization in its roughly 11 years of existence, the first-born crypto is consolidating gains and being pulled along by gold in 2020. Elevated levels in the stock market and many alt-coins increase risks of some reversion, which would encourage more quantitative easing, thus ultimately buoying gold and Bitcoin.

Newbie Bitcoin Being Led Higher by Gold

In an appearance on Bloomberg Television, Michael Novogratz — a veteran Wall Street fund manager and founder of Galaxy Digital Holdings Ltd. — offered the investment recommendation: Bitcoin is a better long-term bet than gold. In spite of gold climbing above its record highs, Novogratz still sees Bitcoin as more worthy investment because it’s “harder to buy” than the traditional haven. He said about 25% of his net worth is tied up in cryptocurrency yet gold is “more of a 5% position”; Bitcoin has “crossed the Rubicon” on the question of whether it’s a good store of value. Now, more institutions and banks are considering how to get into the cryptocurrency, compared with a few years earlier when they viewed it more skeptically. Novogratz said that he thinks the Fed will be more dovish in its September meeting, and its actions could be “the juice that accelerates gold and bitcoin.”

In view of Bitcoin itself as a disruptive technology (Global Internet Money), a hedge against inflation (Digital Gold), and as a means for financial inclusion (Be Your Own Bank), growing investor demand, futures participation and advancing on-chain metrics indicate a firming Bitcoin price base. Consider the pandemic’s global economic fallout: the equivalent of 400 million full-time jobs in lost work hours, a mountain of deferred bankruptcies, unprecedented multi-trillion dollar stimulus packages, and government debt levels above or projected to exceed 100% of GDP. Just as the Great Depression shaped economic decision-making for decades, the shock of COVID-19 will be felt for a very long time.

More Adoption, Maturity — Addresses & Futures

In this inflationary environment, Bitcoin, with its encoded inflation and finite supply, may begin to be perceived as a viable alternative to fiat by more traditional investors. Bitcoin, like gold, is a standout due to its uniqueness and the fact that it’s no one’s liability. In addition, it presents certain advantages over gold as well, such as the aforementioned finite supply and easy instant transferability. Increasing demand is the only Bitcoin metric that really matters. The past two years have seen digital asset markets grow by leaps and bounds, largely due to the rapid maturation and Bitcoin could potentially lead the way.