6 DeFi Lending Platforms (Part Ⅲ)

Here comes the last part of a three-part series. Welcome to read the previous Part Ⅰ and Part Ⅱ as well to get a whole picture of the 6 DeFi Lending Platforms we introduce. In Part Ⅲ, we will be talking about Fulcrum and NUO Network.

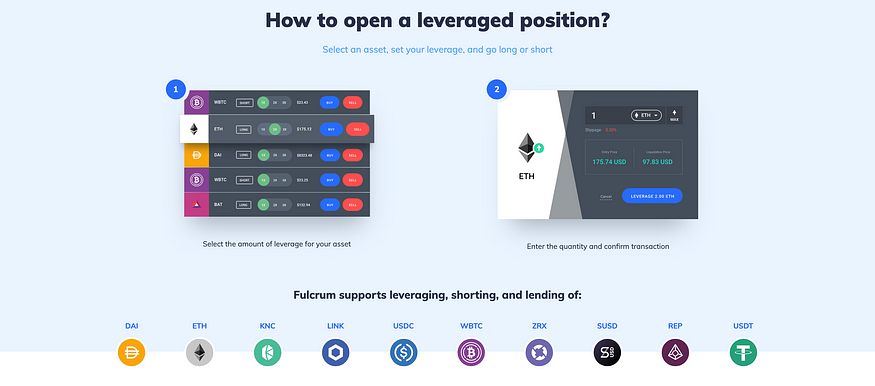

5. **Fulcrum -**Try non-custodial crypto margin trading at DeFi platform Fulcrum. Enter into short/leveraged positions up to 5x without open fees. ETH and wBTC are available.

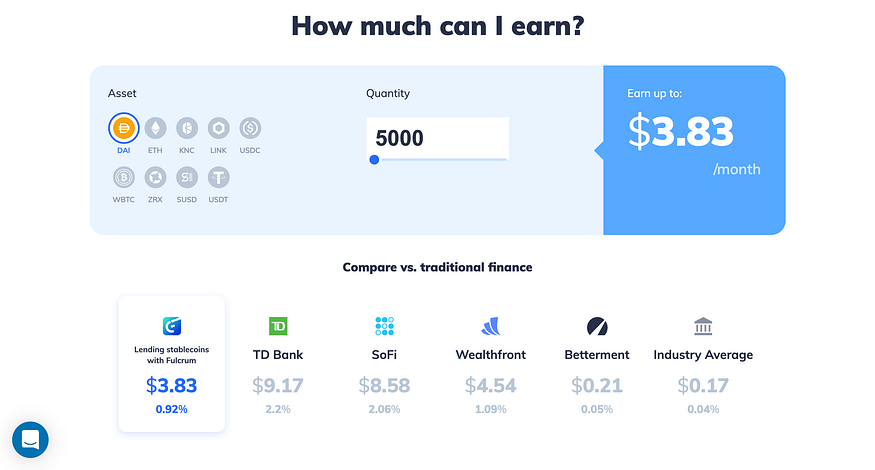

Fulcrum is the platform for tokenized margin trading and lending, enables users to lend assets for interest or enter into short/leveraged positions. It is the interface that allows users to use the actual protocol, called bZx, which enables trustless and permissionless transactions, with no fees, setting aside 10% of the accrued interest for the maintenance of an insurance fund. Fulcrum Trade is a decentralized lending and margin trading platform built on Ethereum. The system leverages the 0x protocol to offer deeper liquidated spreads through the use of shared lending pools. Furthermore, bZx is a strong user of the Ethereum Name Service (ENS), giving each asset and trading strategy a unique domain in an attempt to make their service more digestible to average users.

Fulcrum/bZx uses iTokens, which allow lending and borrowing with certain cryptocurrencies like cTokens. For each of these tokens, there is a corresponding iToken that represents it within the bZx ecosystem, and which interacts with the smart contracts of this platform.

The first difference with other platforms is the choice of the integrated tokens since, for example, the Compound cTokens do not integrate USDT, SUSD or LINK, whereas they do integrate Basic Attention Token (BAT). In addition, the protocol behind Fulcrum, bZx, has a native governance token of its own, called BZRX, which is currently locked and used only to pay fees. The operation of these iTokens is very similar to that of other comparable platforms since in order to grant a loan it is sufficient to swap one of the supported tokens with the related iTokens, in order to send the tokens to the platform in exchange for the iTokens that represent them and allow obtaining an interest in return.

Unlike other lending services such as Dharma, bZx relies on the upkeep of a deep insurance fund to ensure that lenders will always be covered in the event that borrowers are unable to pay back their loans. “The protocol collects 10% of all interest earned by lenders and aggregates it into an insurance fund.” For this reason amongst others, bZx leverages a native token aimed at ensuring the system operates smoothly and with confidence.

Even with regard to obtaining a loan, the operation is similar to that of other decentralized lending platforms, but with one peculiarity: the so-called flash loans. bZx also allows borrowing without collateral, using flash loans. Flash loans are mainly used for trading, and in particular for so-called leveraged operations, and Fulcrum is, in fact, a platform that is not limited to lending, such as Compound, but also allows margin trading. The same is true of other DeFi platforms, such as dYdX which offers margin trading but without flash loans, or Aave which offers flash loans but not margin trading.

How to use Fulcrum

Lenders and Borrowers place orders via a Relayer, and once matched, the Borrower receives a margin loan. While these margin funds are being used, off-chain bounty-hunters are monitoring the solvency of a margin account. If there’s a risk of borrowed funds being lost, bounty-hunters initiate position liquidation and subsequent refund to the Lender. Borrowers are free to do whatever they wish with their newly loaned tokens, prompted to deposit additional funds in the event of collateralization ratios that may induce future liquidation.

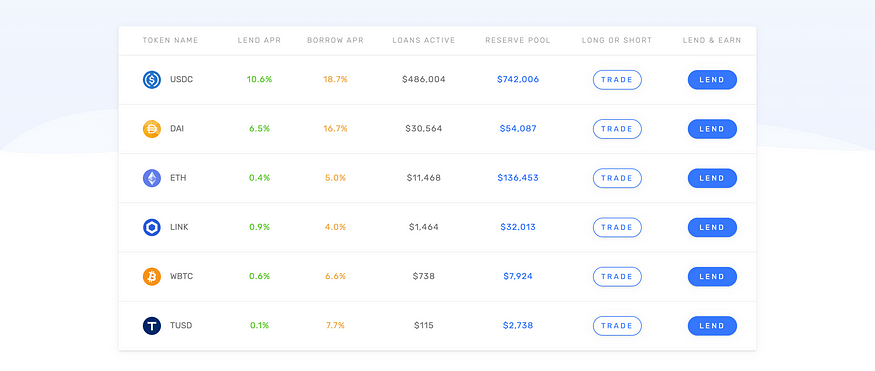

Support Assets

The cryptocurrencies and tokens supported by Fulcrum are Ether (ETH), DAI and SAI, Wrapped Bitcoin (WBTC), USDT, USDC, SUSD, Chainlink (LINK), 0x (ZRX), Augur (REP) and Kyber Network (KNC)

6. **NUO Network -**Lend and Borrow Cryptocurrency. The non-custodial way to lend, borrow or margin trade crypto assets

Nuo Network is a non-custodial platform on Ethereum that provides a decentralized debt marketplace where users can interact with Ethereum-based assets in a number of ways. Users can lend, borrow, or margin trade any supported crypto asset. c).

Lenders can earn interest by adding collateral to pooled debt reserves, which are used to fund loans and leveraged trades. Lenders receive a share of the daily interest paid by borrowers, in proportion to their share of the debt reserve. Borrowers can take loans of up to 70% of their collateral’s value, and traders can borrow up to 3x their collateral’s value for leverage. Interest rates adjust algorithmically based on the level of debt reserves.

Nuo has added assets and features, including mobile compatibility and Wyre integration (for converting fiat to Dai or ETH). Nuo’s smart contracts are open source and have undergone an audit by Quantstamp. Nuo uses Kyber and Uniswap to execute trades. Nuo has no native token and charges no fees. The platform covers the majority of users’ gas fees. By leveraging meta transactions Nuo users do not need to pay for transaction fees after their initial deposit.

In April of 2020, Nuo added the Nuo Exchange — a gasless DEX allowing users to swap between any two ERC20 tokens with no transaction fees.

How to use Nuo Network

To create an account, head to the Nuo Network app and create an account, either with MetaMask or Coinbase Wallet, or by creating a username and password. You’ll get a temporary trading account address that you can make permanent by adding funds within six hours.

When supplying capital to Nuo, the platform creates a debt reserve where lenders begin to earn interest based on the daily loan repayments of the asset’s reserve pool. Unlike other lending platforms like Compound where interest accrues in real-time, lenders on Nuo start receiving interest after 2 days of the collateral being locked starting at 00:00 GMT, and interest will be distributed on a daily basis every day following.

Support Assets

As of March 2020: ETH, DAI, SAI, KNC, ZRX, MKR, REP, BAT, WBTC, USDC, LINK, and TUSD