6 DeFi Lending Platforms(Part Ⅱ)

Thanks for sticking around! This is the second part of a three-part series. You should read Part Ⅰ first which covers Aave and dYdX. In Part Ⅱ, we will be talking about Compound and Maker.

3. **Compound -**Compound is an algorithmic, autonomous interest rate protocol built for developers, to unlock a universe of open financial applications.

Compound is an open-source, autonomous protocol built for developers, enable algorithmic, efficient money markets on the Ethereum. By adding digital assets into the Compound, liquidity pool crypto holders can earn interest, which adjusts automatically in relation to supply and demand. Compound leverages audited smart contracts responsible for the storage, management, and facilitation of all pooled capital. Users connect to Compound through web3 wallets like MetaMask with all positions being tracked using interest-earning tokens called cTokens.

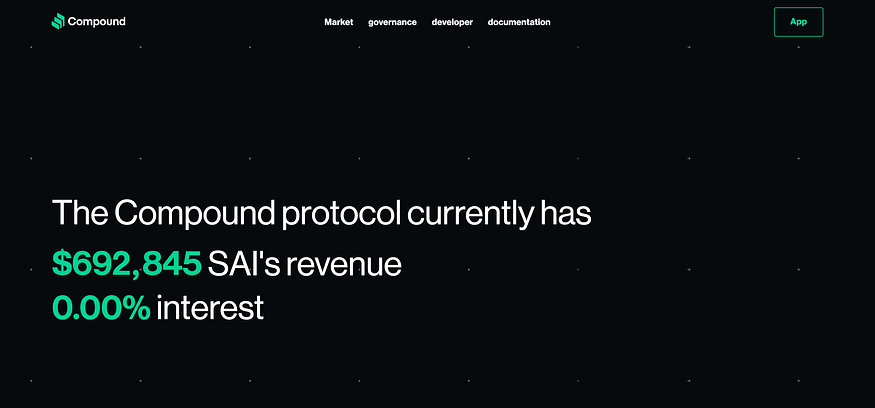

The automated interest rates ranging from 2–8% on Ether, as well as DAI and a variety of other stablecoins. The protocol is considered to be the crypto-version of a money market fund and is compatible with Ethereum wallets like Metamask, Coinbase, and Ledger. Lenders and borrowers have matched automatically through the Ethereum-based protocol, eradicating the need for third parties. The Compound protocol currently has over $128.4 million locked up in its liquidity pools and has emerged as one of the most popular decentralized lending platforms today.

Anyone can supply assets to Compound’s liquidity pool and immediately begin earning continuously-compounding interest. Rates adjust automatically based on supply and demand. Supplied asset balances are represented by cTokens: representations of the underlying asset that earn interest and serve as collateral. Users can borrow up to 50–75% of their cTokens’ value, depending on the quality of the underlying asset. Users can add or remove funds at any time, but if their debt becomes undercollateralized, anyone can liquidate; a 5% discount on liquidated assets serves as an incentive for liquidators. The Compound protocol sets aside 10% of interest paid as reserves; the rest goes to suppliers.

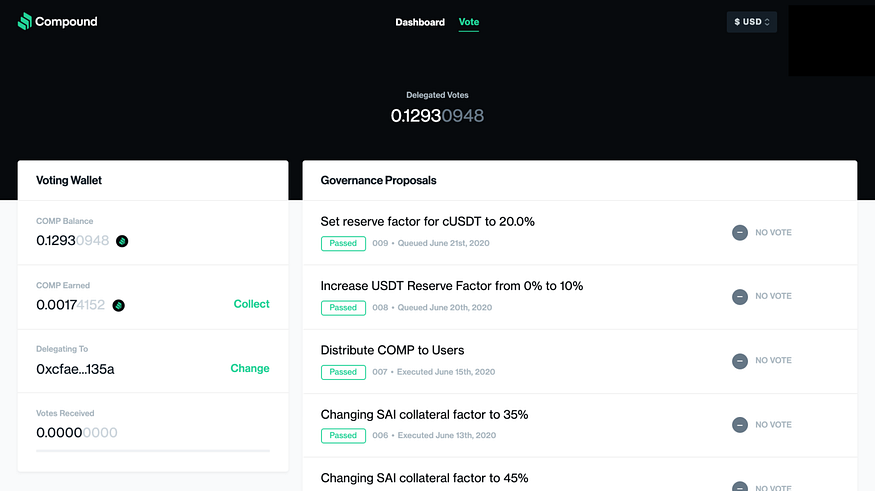

Compound recently introduced a governance token — COMP which allows tokenholders and delegates to vote on important protocol decisions like new collateral types, borrowing power, and interest rate models. COMP holds no economic benefits and is solely used to vote on protocol proposals. What’s unique about COMP’s governance model is that tokenholders can delegate their tokens to an address of their choice. As of May 2020, Compound has transitioned to community governance; COMP token-holders and their delegates debate, propose, and vote on all changes to Compound.

How to use Compound

Borrowers can access their assets in any location to borrow against, and Compound makes it easy to integrate their protocol into your Ethereum wallet by just a click of the app button on their landing page. The best place to use Compound is the native interface. Just enable any asset to start supplying or borrowing it. You can also check your balance and current interest rates.

COMP was recently listed on Coinbase — the leading US cryptocurrency exchange and has seen strong interest from dozens of other exchanges including futures platforms like FTX. The distribution of COMP has absolutely exceeded expectations on all fronts. Compound is now the leading DeFi protocol both in terms of Total Value Locked and in terms of COMP’s market cap relative to other DeFi tokens.

Support Assets

BAT, DAI, SAI, ETH, REP, USDC, WBTC, and ZRX.

4. **Maker -**Builders of Dai, a digital currency that can be used by anyone, anywhere, anytime.

MakerDAO is a decentralized credit platform on Ethereum that makes use of Collateralized Debt Position (CDP) to create the stablecoin Dai (DAI), which has its value pegged against the US dollar. Dai is generated when users deposit ether (ETH) as collateral in CDPs.

Dai can be used to lend (to earn interest), to make payments, to trade, or to invest in other Ethereum-based assets. It is the only decentralized, stable digital currency that anyone can use without limitations. Unlike other dollar-pegged stablecoins, it does not hold dollars in a bank. Instead, the Maker protocol uses smart contracts and collateral in the form of ETH to maintain the price peg.

Anyone can use Maker to open a Vault, lock in collateral such as ETH or BAT, and generate Dai as debt against that collateral. Dai debt incurs a stability fee (i.e., continuously accruing interest), which is paid upon repayment of borrowed Dai. That MKR is burned, along with the repaid Dai. Users can borrow Dai up to 66% of their collateral value (150% collateralization ratio). Vaults that fall below that rate are subject to a 13% penalty and liquidation (by anyone) to bring the Vault out of default. Liquidated collateral is sold on an open market at a 3% discount.

Holders of Maker’s other token (MKR) govern the system by voting on, e.g., risk parameters such as the stability fee level. MKR holders also act as the last line of defense in case of a black swan event. If the system-wide collateral value falls too low too fast, MKR is minted and sold on the open market to raise more collateral, diluting MKR holders. Maker also has a feature called the Dai Savings Rate (DSR). DAI holders can lock their DAI into Maker’s DSR contract and earn a variable interest rate in DAI, which is generated from stability fees.

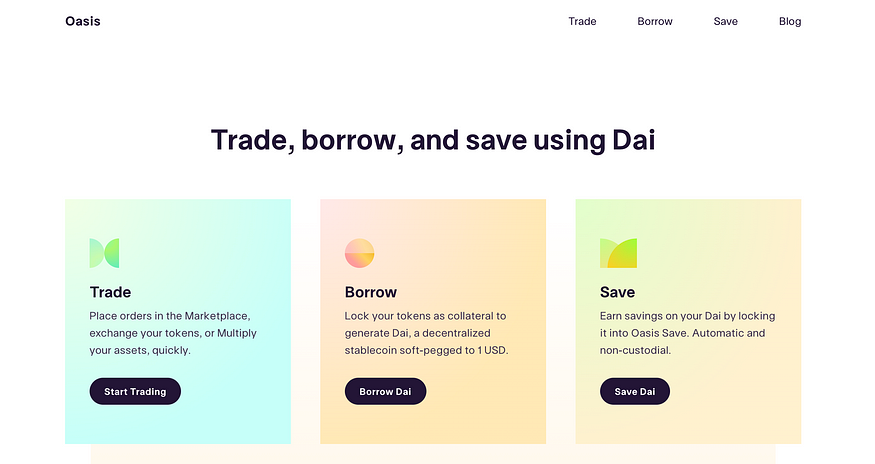

How to use Maker

The most popular place to use MakerDAO is Maker’s Oasis Portal. There you can open and manage Vaults, review your Vault’s history, deposit DAI into the Dai Savings Rate, and get up-to-date stats on the whole Maker system.

Here we wrap up Part Ⅱ. Please stick to Part Ⅲ for further reading…